Water damage accounts for 25% of insurance claims from 2009-2013. Understanding what your water damage insurance covers is essential for protecting your home. It’s wise to consult your insurance broker to clarify your policy’s specifics and ensure you’re fully informed.

The source of water damage is crucial to your claim. Different insurance policies vary widely among companies, and knowing the source of the damage can determine whether your insurance will cover repairs or restoration. While it may seem overwhelming, being informed now will benefit you in the long run.

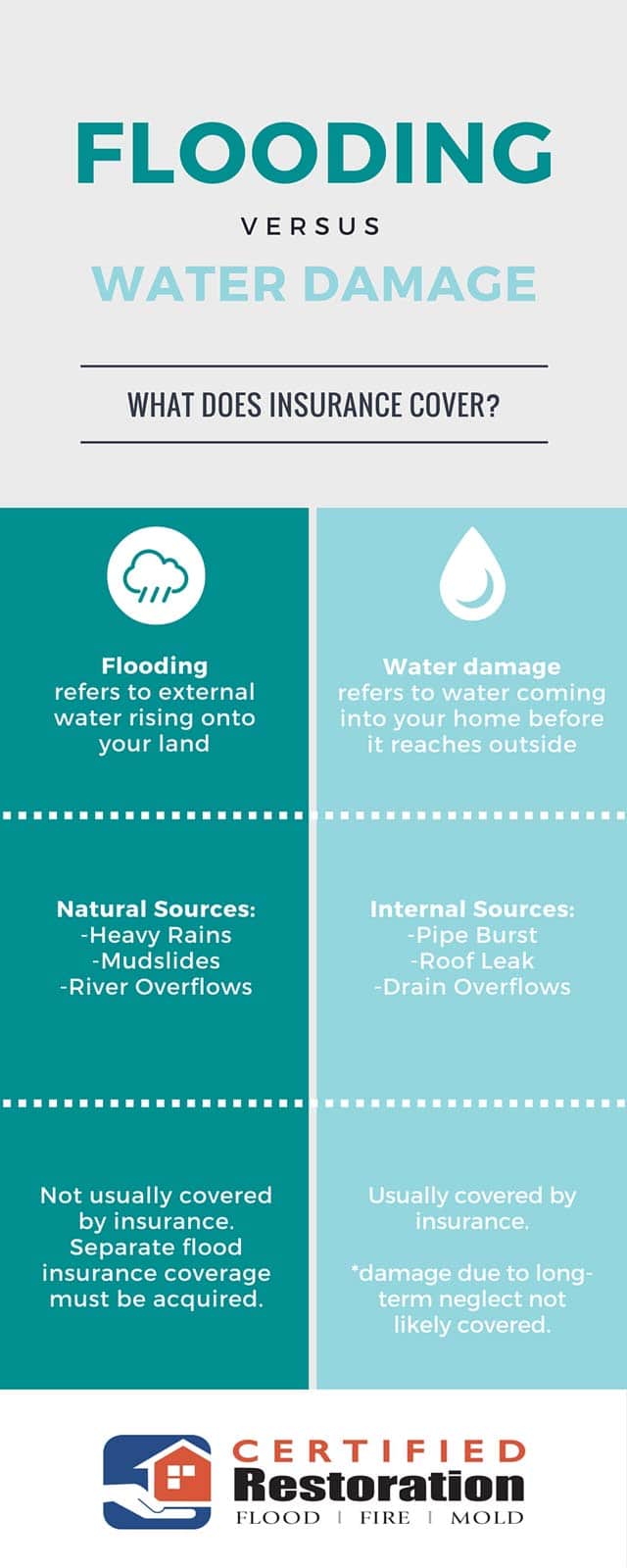

Understanding Water Damage vs. Flood Damage

It’s important to distinguish between water damage and flood damage, as they may have different coverage options. For a clear visual guide, check out our image resource below to help you understand these differences.

Key Coverage Areas to Consider

1. Water Damage Restoration in San Diego: Many policies cover damage from sudden and accidental water incidents, like a burst pipe or an overflowing bathtub.

2. Flood Damage Restoration San Diego: Flooding, especially from external sources, often requires separate flood insurance, as most standard homeowner policies do not cover it.

3. Mold Damage Restoration: If water damage is not addressed promptly, mold growth can occur, leading to further complications. Be aware of how your policy covers mold remediation.

4. Emergency Water Restoration: Knowing the steps to take after water damage occurs is crucial. Look for water damage restoration companies near you that can provide 24/7 assistance.